IN MY last column I promised to return the issue of those land valuations once the BOA had given me some answers that I asked for. Here we are.

A beginning note: The criticisms of the property tax system that will follow in this column should not be seen as a criticism of the staff of the Chatham County Board of Assessors (BOA).

However, it might be seen as a criticism of whatever higher-up made the decision to change the valuation method for land in the case of certain “neighborhoods”.

In particular, I would like to single out Robbin Bowen for putting up with my multiple phone calls and emails, and always doing so in a polite and friendly manner.

The staff of the BOA has a big job. The BOA must keep current valuations for every property in the entire county.

If you want to hire a private appraiser to come up with a value for your property, it will probably run you about $500. That private appraiser is going to be very detailed, and look at a lot of nuances that the BOA appraisers just don’t have the capacity to look at on a property-by-property basis.

That is why they engage in “mass appraisal” using computer software, and identify cohorts of like properties as described in my previous column. Nuances typically only get looked at when there is an appeal.

If you want more info on this, I urge you to go to boa.chathamcounty.org.

Or, to go even further down the rabbit hole, you can go to the Georgia Department of Revenue property tax homepage at: dor.georgia.gov/property-taxes-georgia

I previously skipped over the valuation of residential structures, so let me address that quickly. It’s pretty simple once you understand it.

First, the Replacement Cost New (RCN) is determined. This is the cost, in current market conditions, to build a new structure similar to the one that exists. I’m pretty sure the software does this, based on a handful of physical characteristics.

Next, from this value, depreciation is subtracted, as a percentage, based on the age of the actual structure. This results in Replacement Cost New, Less Depreciation (RCNLD).

Once you know these acronyms, they are easy to spot on your property record card, and you can actually see the work that was done in deriving the improvement valuation.

Finally, the RCNLD is then altered, perhaps, based on recent sales. When looking at recent sales, are the prices significantly higher or lower than their RCNLDs?

If yes, and the result is fairly consistent across the cohort of like properties (the “neighborhood”), then a final market adjustment will be made for all properties across that cohort, as a percentage either added or subtracted from the RCNLD. This produces the market value.

Looking at the sales comps used for several neighborhoods, I saw that this methodology was applied consistently and fairly. However, I might argue with the boundary of the cohort groups, or that some properties in one cohort really belong in another, etc.

Nuances.

But back to the land valuations that I described two columns ago. I still have a problem with those. I still believe that they are systematically flawed, to the great detriment to owners of smaller land parcels.

When I contacted the BOA about these, I asked why the per-square-foot methodology had been changed to a price-per-lot methodology, and how that standard price had been determined.

It took awhile to get answers.

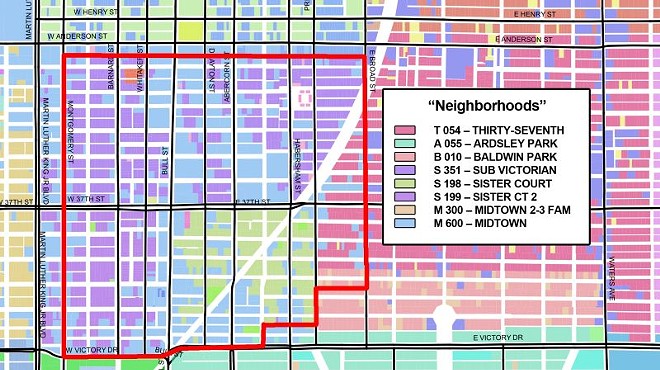

I will only be addressing the cohort labeled “S198 – Sister Court” as that is where I live. This cohort saw the highest standard land value applied ($65,000), and this shit is exhausting.

I was told that the change was made based on two data points:

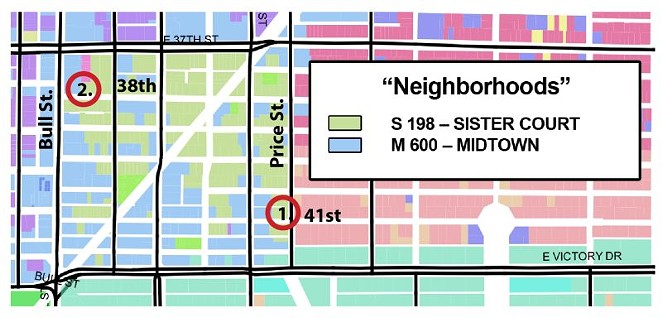

1) A 5400 s.f. vacant parcel at 416 E 41st St. sold on May 26th of 2015 for $70,000.

2) A 2850 s.f. vacant parcel at 8 E 38th St. sold on July 5th of 2016 for $65,000.

The conclusion that was drawn from these two data points was that due to their similar sales price, but disparity in size, the market was pricing all parcels in the cohort at roughly the same price, regardless of size.

Putting aside the advisability of making ANY conclusion based on two data points, this is quite the specious argument. I’m pretty sure that almost any observer, even one with no experience in real estate, would look at this conclusion and immediately think, “OR, the smaller lot is obviously worth more per square foot than the larger lot.”

Conclusion A: Vastly different sized properties are worth the same overall amount.

Conclusion B: The first property is worth $13.00 per square foot. The second property is worth $23.00 per square foot. There must be some differences that account for this disparity.

Conclusion B is the argument that I would make (were I to make an argument based on two data points), so let’s look at why the smaller property might be more valuable.

8 E 38th St. is right next to The Vault and the rapidly improving Bull Street corridor from 37th Street to Victory Drive that is the heart of the Starland District. You could fall out the door of a structure built here and walk to a dozen local amenities in mere minutes.

416 E 41st St., while still in a nice, walkable neighborhood, is as far from the “hot” corridor as one can get, and still be in the same cohort of properties.

These relative positions alone could account for the price disparity, but there is an added wrinkle.

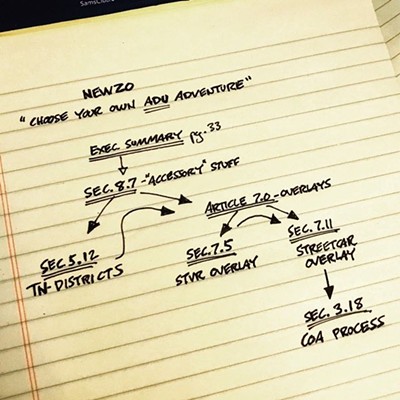

Though both properties show up in Savannah Area Geographical Information System (SAGIS) as TN-2 (Traditional Neighborhood – a mostly residential zoning category that only exists in MidCity, at least until NewZO is implemented), 8 E 38th was listed for sale in the Multiple Listing Service (MLS) as TC-1, which comes with considerably more latitude in development and use, including the ability to have an STVR without an on-property owner.

Did the buyer believe that they were purchasing a parcel that was zoned TC-1, right on the main Starland corridor?

This is not an insignificant question, and could certainly affect the price that a buyer was willing to pay.

Finally, I would argue that in this local historic district (MidCity), where contributing structures are protected from demolition, a vacant parcel cannot be used as a price proxy for parcels lying beneath protected structures.

If you want yourself some new construction in this area, you can’t just buy any run-down property and demolish what is there. That makes a vacant lot a fundamentally different product than one with a protected structure on it.

And vacant lots are scarce, and therefore valuable. This one at 8 E 38th St. exists because of a house fire in 2014 that allowed for the previously existing stricture to be demolished.

So there you have it – I still think a standard lot price is absurd, and especially one based on these two data points.

If land prices must be raised, then perhaps use the sale of 416 E 41st St. as a rationale for a bump of the per square foot method up to $12 or $13. That would be much more fair across disparately sized parcels.

While I certainly have not exhausted the subject of property taxes, I hope that the dangling thread from the previous column has been tied off, and I can leave this subject behind for a bit.

However, as I’ve alluded to previously, I did file appeals on the valuation of my property, which I have never done before.

I’ve heard some stories that an appearance before the Board of Equalization, which is one method of dealing with appeals, can be an interesting experience.

If that proves so, you might be getting one more column in this series. cs